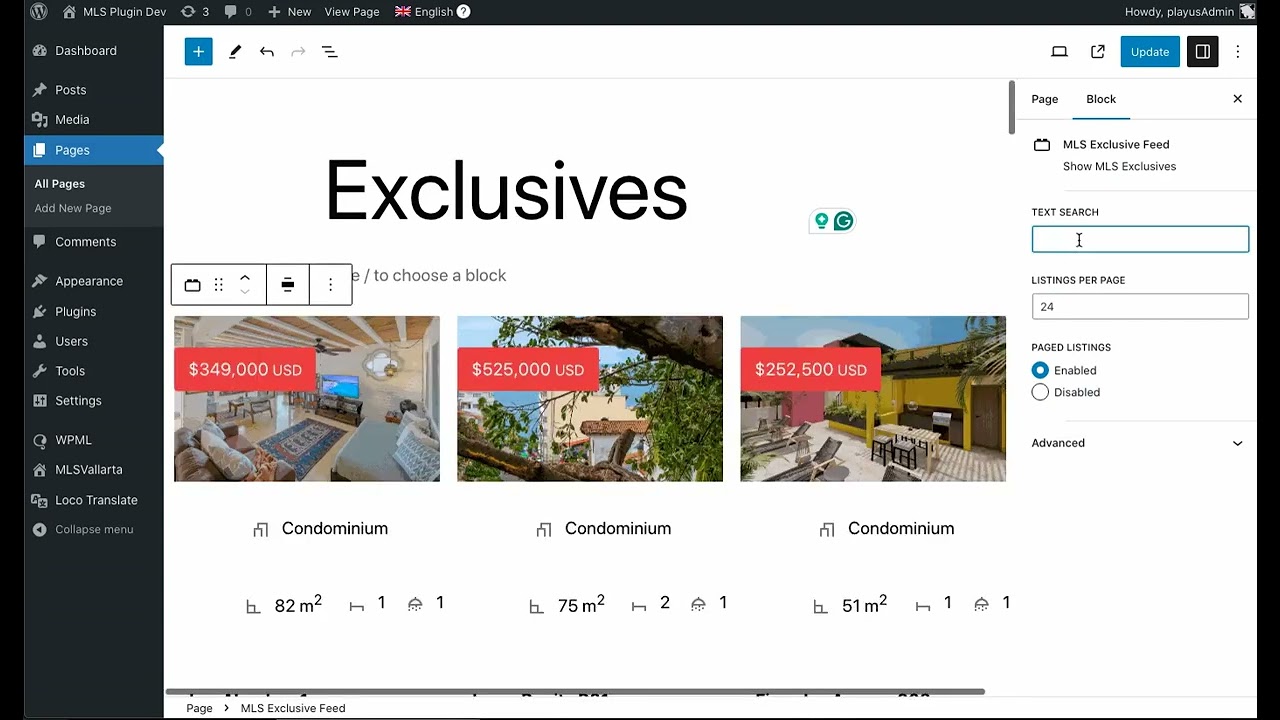

Create a page containing all your agency exclusives using a Gutenberg block.

Create a page containing all your agency exclusives using a Gutenberg block.

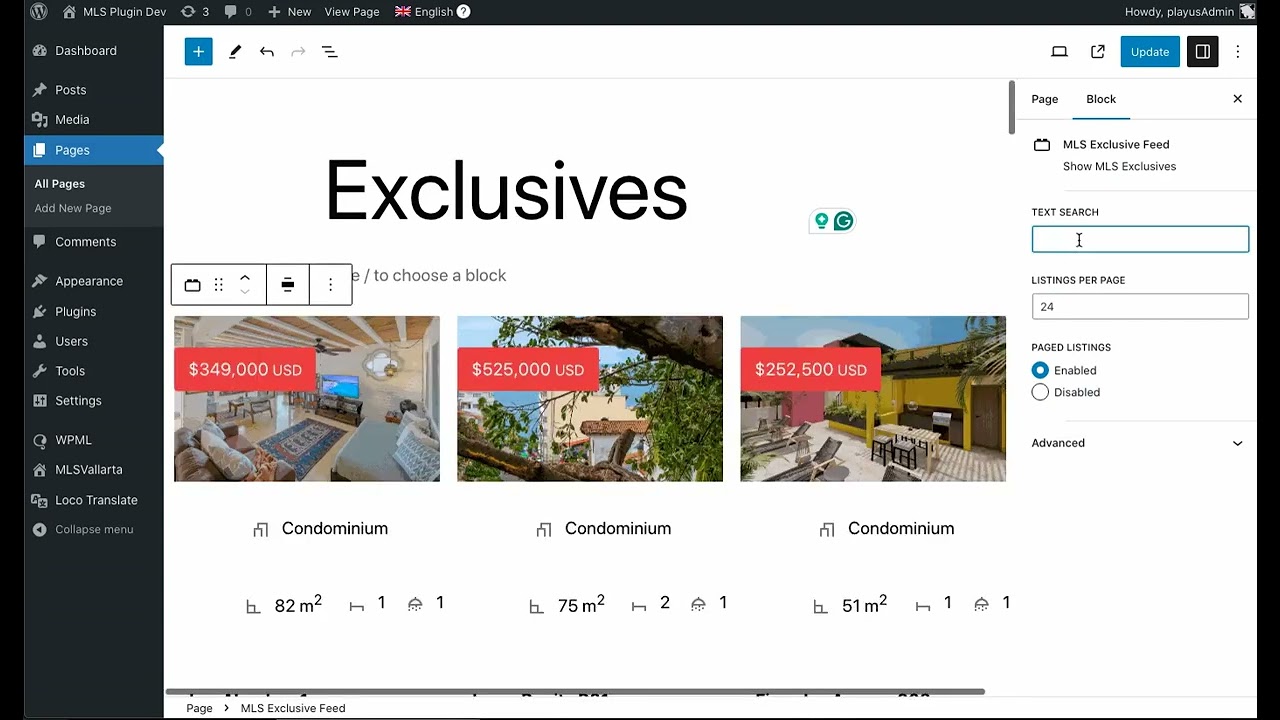

Our development page feature allows you to display a list of all the developments available in MLSVallarta with their inventory.

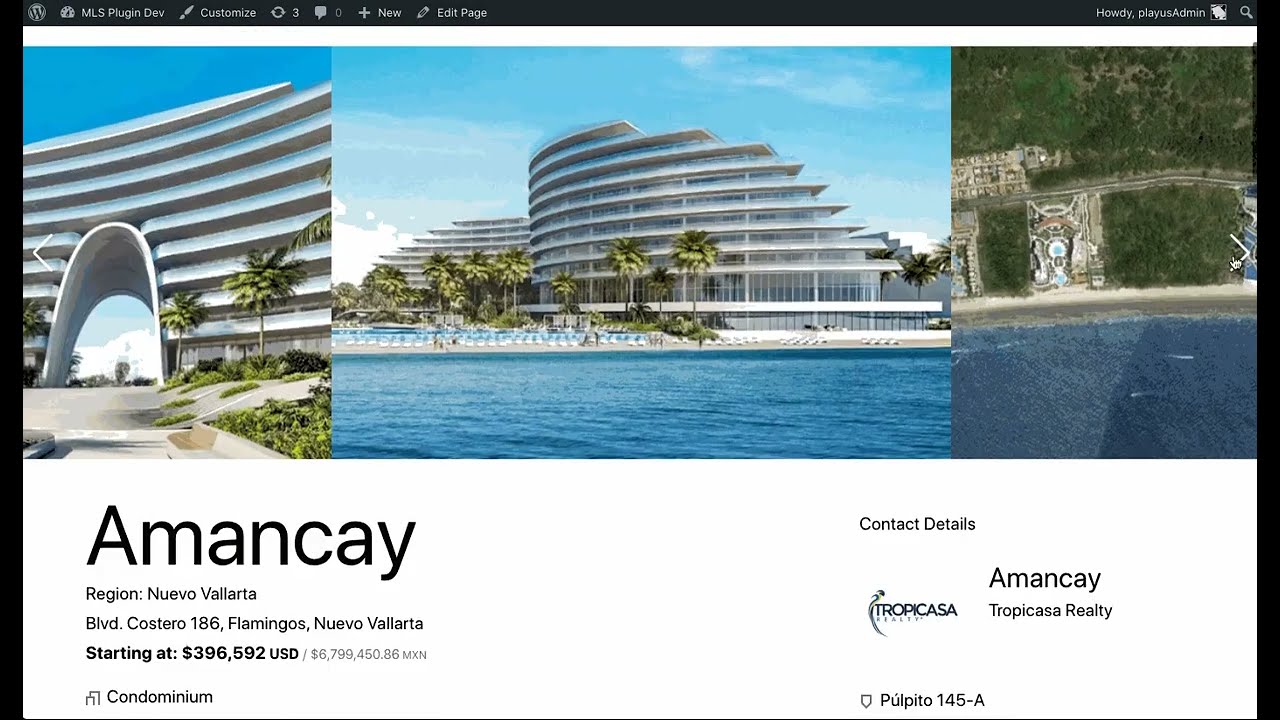

Comply with the new NOM and display all the property prices in MXN using a Banxico Key with your MLSVallarta WP Plugin.

Add an agents block to your site content with our new MLSVallarta “Agents Block”

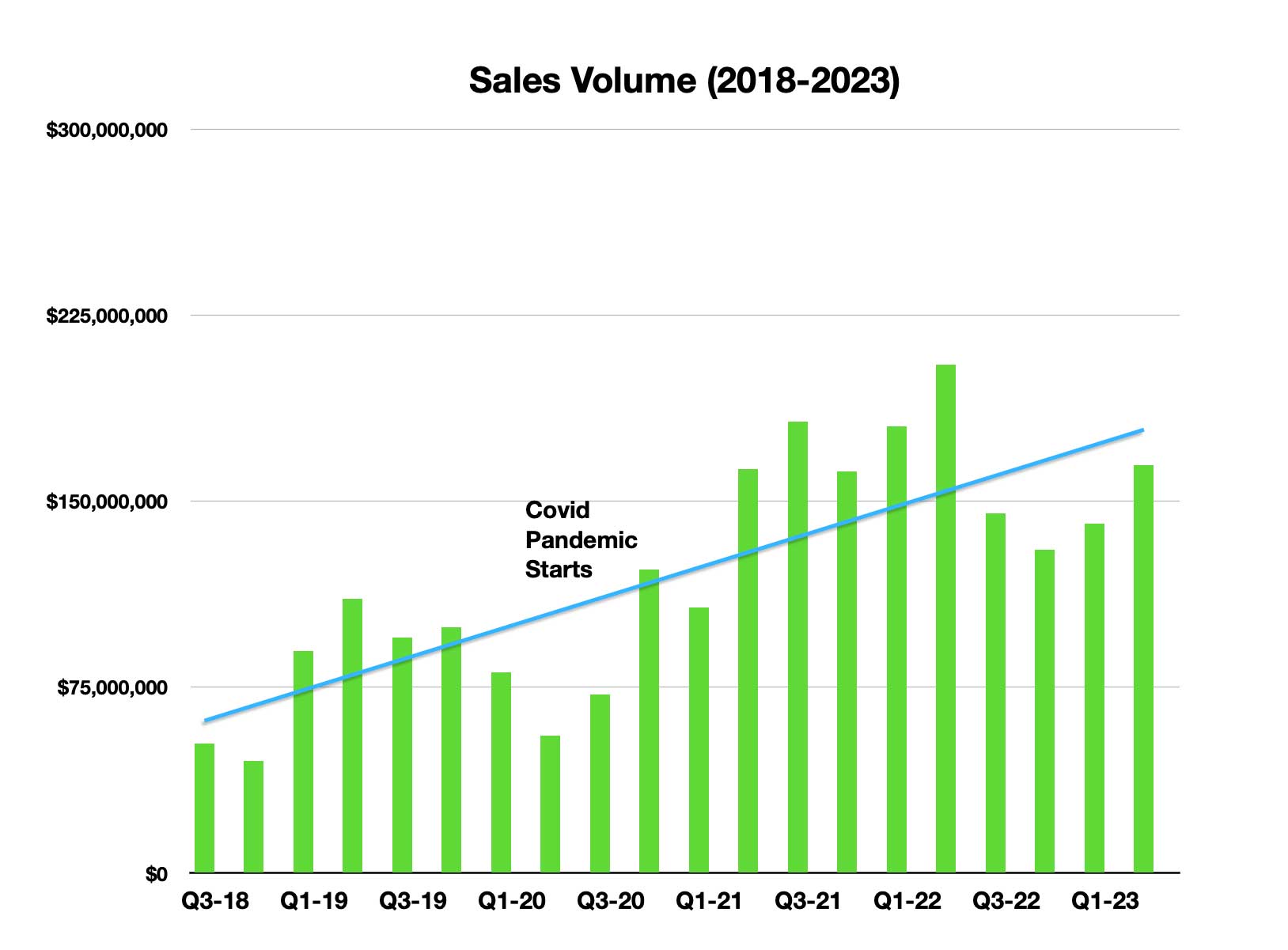

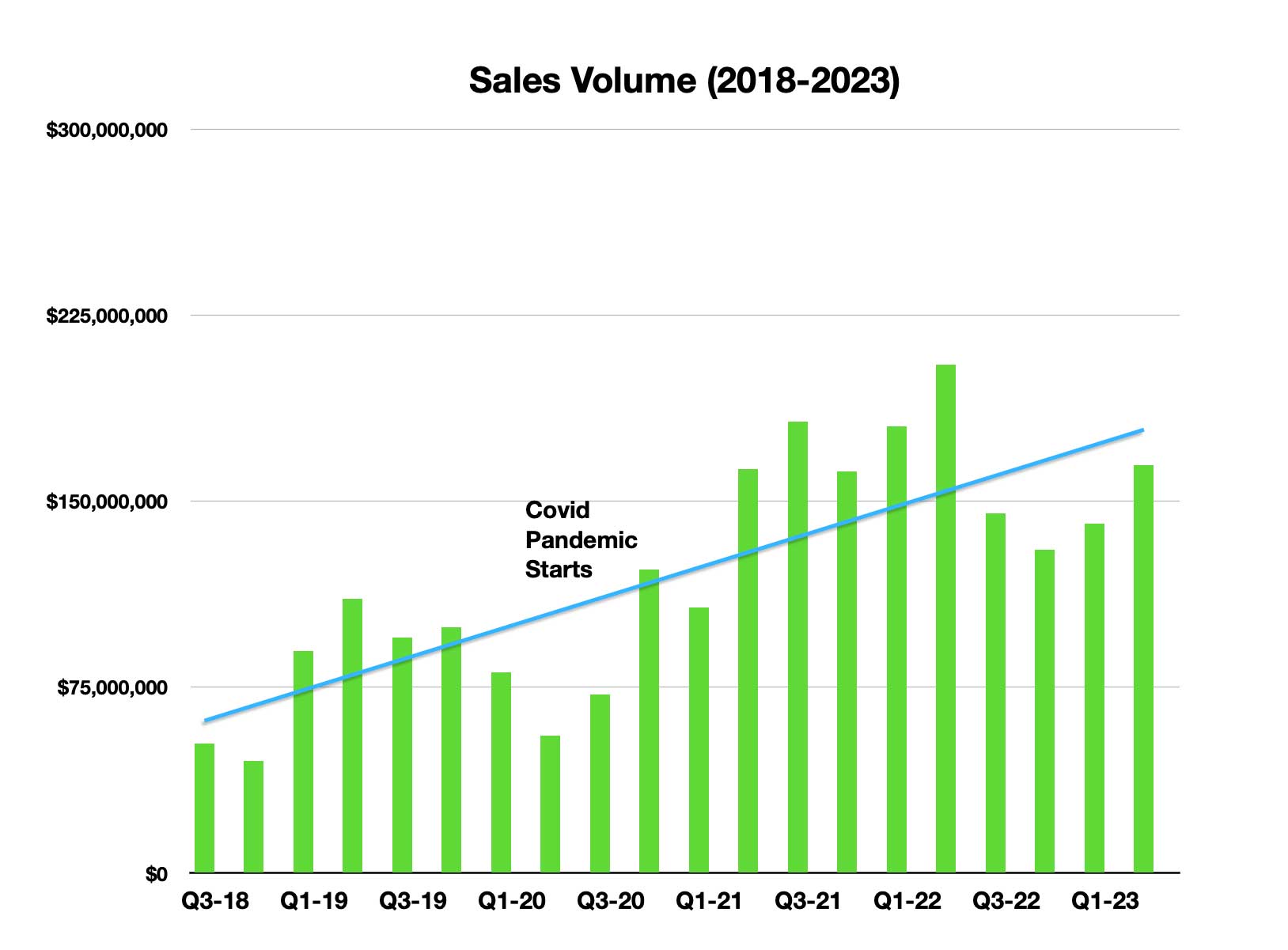

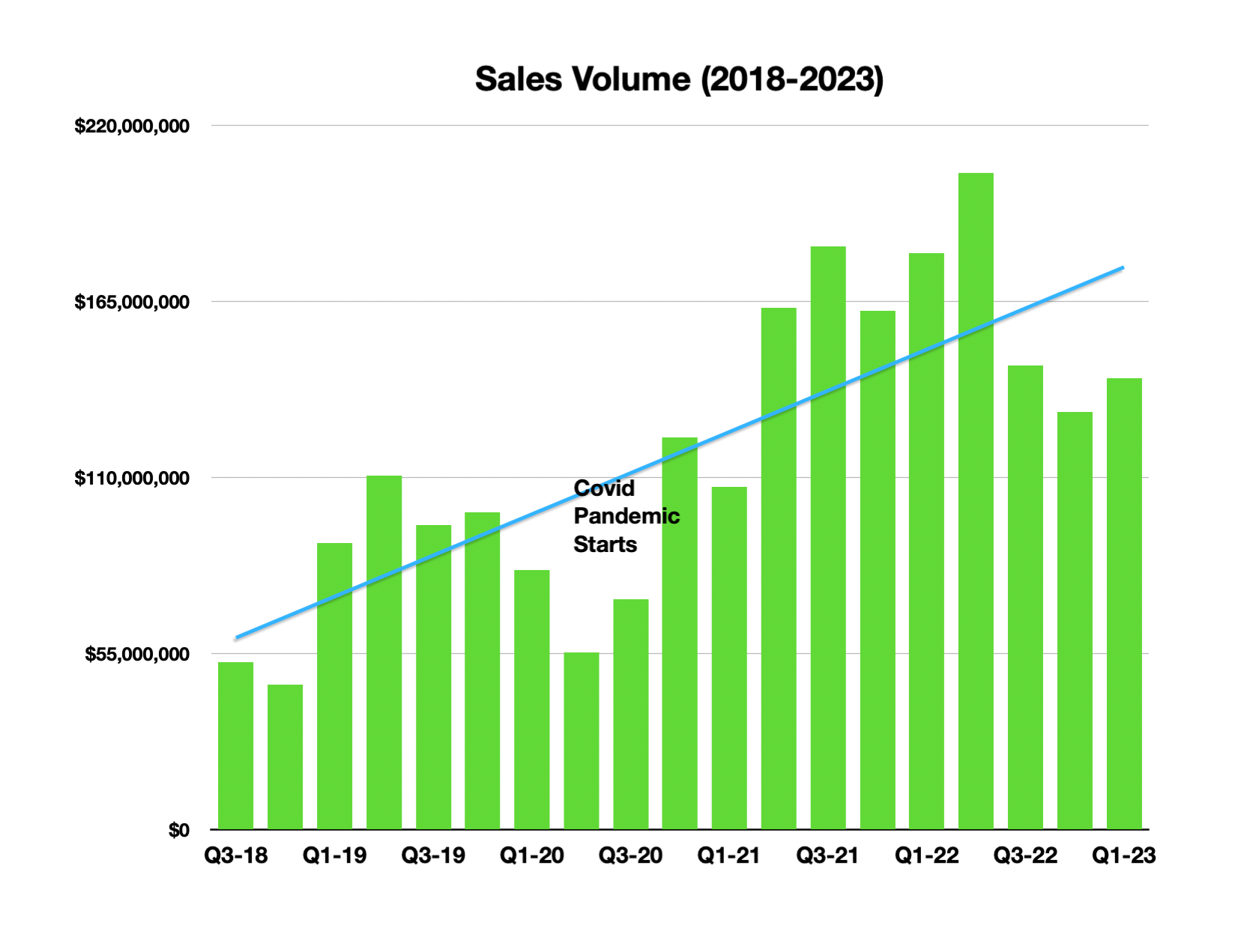

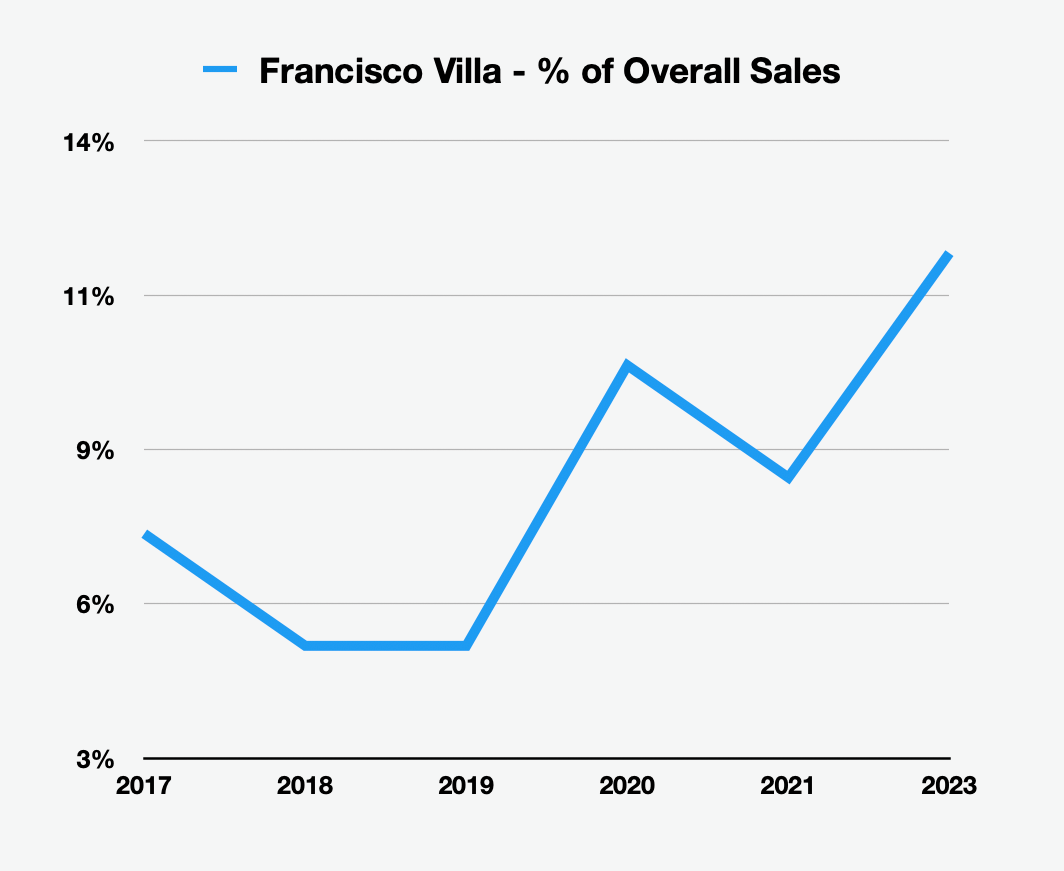

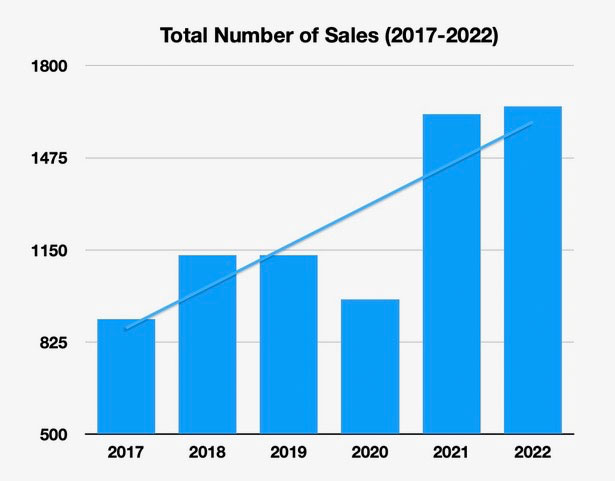

The results for the second quarter of this year shows gross sales for the Puerto Vallarta/Riviera Nayarit region real estate market was up by 14% over the first quarter of this year, marking three straight quarters of gains. Sales volume is now more in line with the historical trend line, as shown in blue below.

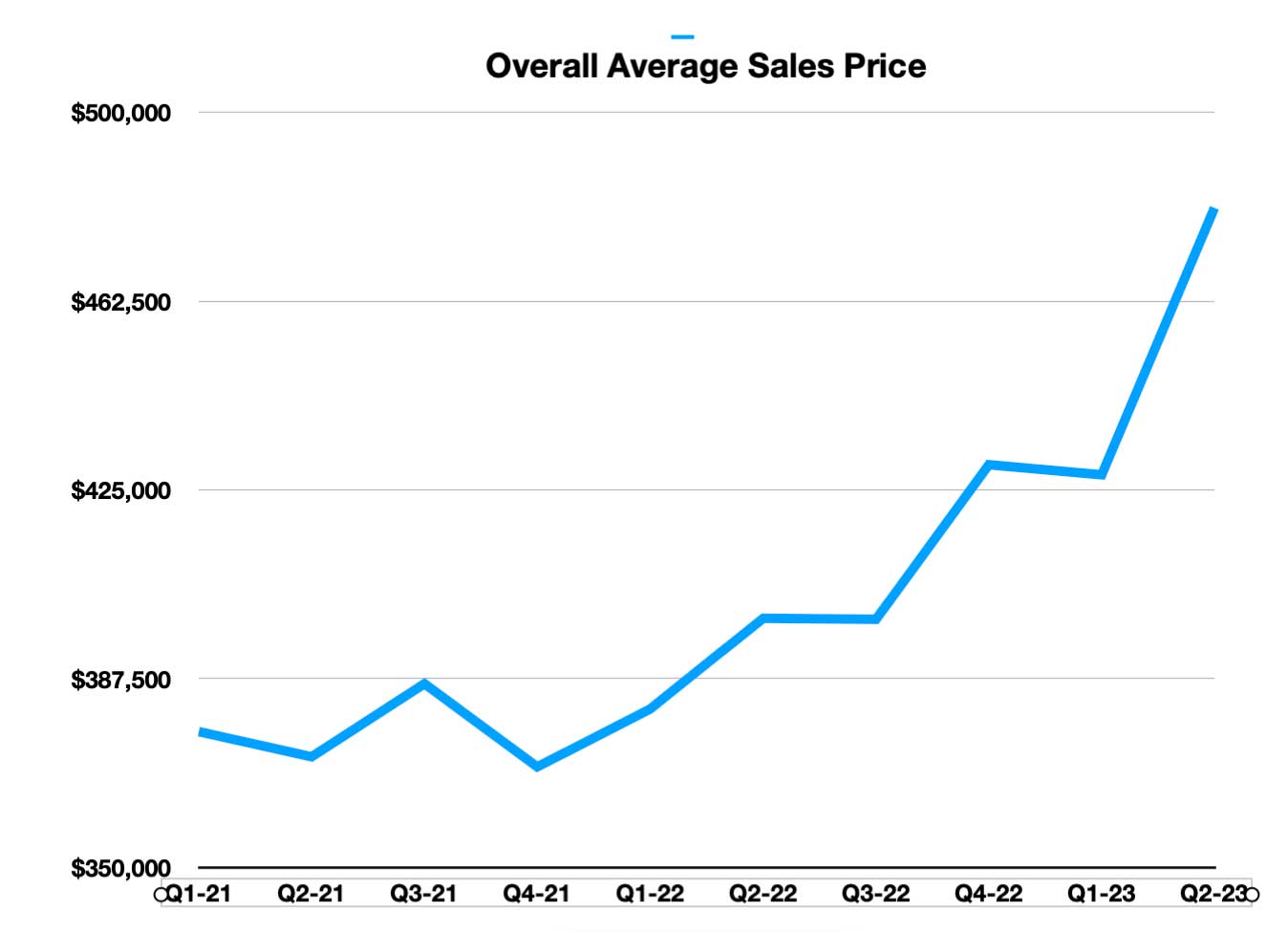

Interestingly, however, that gain was obtained with roughly the same number of sales as the previous quarter, meaning the average price per sale has increased significantly. In the first quarter the average sales price was $420,000 while in the second quarter it was $481,000, more than a 12% increase and posting the highest average sales price recorded to date.

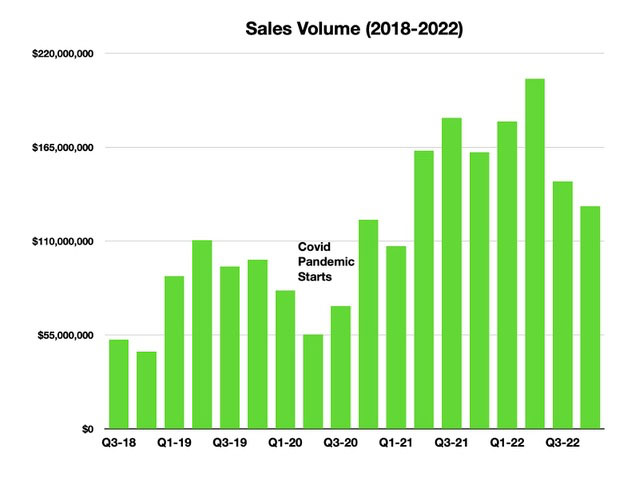

What’s this all mean? That the market continues to be very tight with more demand for housing than there is supply. Another marker of a tight market is the difference between the list price and the sales price, which is traditionally between 8-10%. This difference has been steadily shrinking over the past year, showing a 4.5% list-to-sold price ratio for this current quarter. A review of sold prices shows that many are selling for what the property is listed for, and in some cases, for more.

In terms of which regions are the most popular according to number of sales, Nuevo Vallarta and Bucerias in Riviera Nayarit once again, as in the first quarter, took top honors. They were followed by Central Vallarta and the South Shore (between Vallarta and Boca de Tomatlán). The most economical region to purchase (lowest average sales price) continues to be behind the Hotel Zone, in areas such as Versalles, Fluvial and Las Gaviotas that have becoming increasingly more popular with buyers.

An interesting trend currently taking place is with regards to the strong value of the Mexican peso against the US dollar. At the end of March in 2020 the rate reached a high of nearly 25 pesos to the US dollar. Since then, for more than two years now, the peso has continued to appreciate in value, so that as of July of this year the exchange rate was under 17 pesos to the dollar, meaning the peso has appreciated more than 40% over the last 28 months.

This has had a profound affect on national buyers who bought into the Puerto Vallarta market primarily because real estate was priced in USD, as a way to hedge their pesos. With restrictions on USD accounts in Mexico, and increased difficulty of holding one in the US for Mexican Nationals, Vallarta’s real estate became a safe haven for them. For years this worked very well for national buyers. As an example, for someone who bought a property in Vallarta in pesos in 2010 would have seen the value of their property double in ten years, just because of the change rate, and the fact that real estate in Vallarta is sold in USD. However, for someone who may have bought a property in 2020 for US$100,000 but paid in pesos ($2.5 million pesos), if they sold it today for the same price in US dollars, they would receive back only $1.7 million pesos – a considerable drop in value. Fortunately, however, prices have appreciated over this time period, hopefully enough so that national buyers could recoup their original investment.

For American sellers, since the Mexican land registry registers properties in pesos, this has recently been an unforeseen gain for them. If they’d bought a property in 2020 for US$100,000, it would have been registered at $2.5 million pesos. But if they sold it today for US$150,000, realizing a US$50,000 gain, the sale would be registered in pesos at today’s exchange rate, which would be $2.55 million pesos, meaning it would show a gain of only $50,000 pesos. Long story short, they’d walk away with a US$50,000 gain and have paid little-to-nothing in capital gains taxes.

For many years this worked against American buyers. In some cases, they could end up having to pay capital gains taxes when they actually didn’t see a gain in USD terms. But today, at least over the past couple of years, the table has been turned around.

The US dollar is viewed internationally as a safe haven as it can protect asset values in times of recessions and market downturns. In the chart above you can see two times when the Mexican peso lost value quickly over the past 20 years; once during the 2007-2008 financial crisis and again during the Covid pandemic, which resulted in a recession, in 2020. So in times of trouble the Mexican peso has traditionally lost value extremely quickly. Since 2020 the markets have been relatively calm with stock markets seeing a slow rise in value. It will be interesting to see how the peso will react when there is the next (inevitible) market downturn.

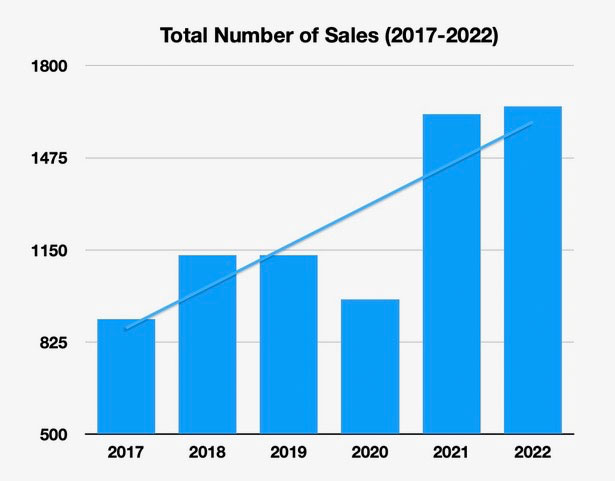

The Puerto Vallarta/Riviera Nayarit region reported gross sales volume of $141 million for the first quarter of 2023, just slightly above the fourth quarter of ’22, but still more than 30% below the all-time high reached in the second quarter of last year with $205 million in sales. That increase in sales, though, was most likely the result of pent-up demand when buyers pulled back during covid. Although volume for the 1st quarter of this year is lower, it’s still above what was reported pre-covid, as the chart below shows.

The Vallarta/Nayarit continues to suffer from a lack of inventory, but should return to a more balanced portfolio of properties as developers continue to build new products to add to existing inventory.

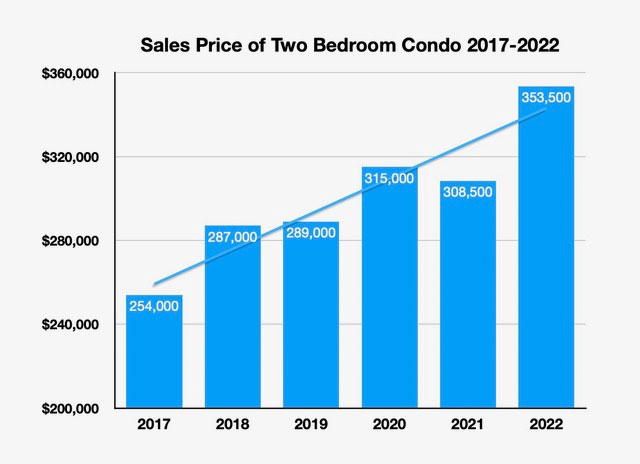

The price of a two-bedroom condominium continues to rise, as the chart below reflects. This is a nearly 20% increase over the average price in 2022 and a 66% increase since 2017.

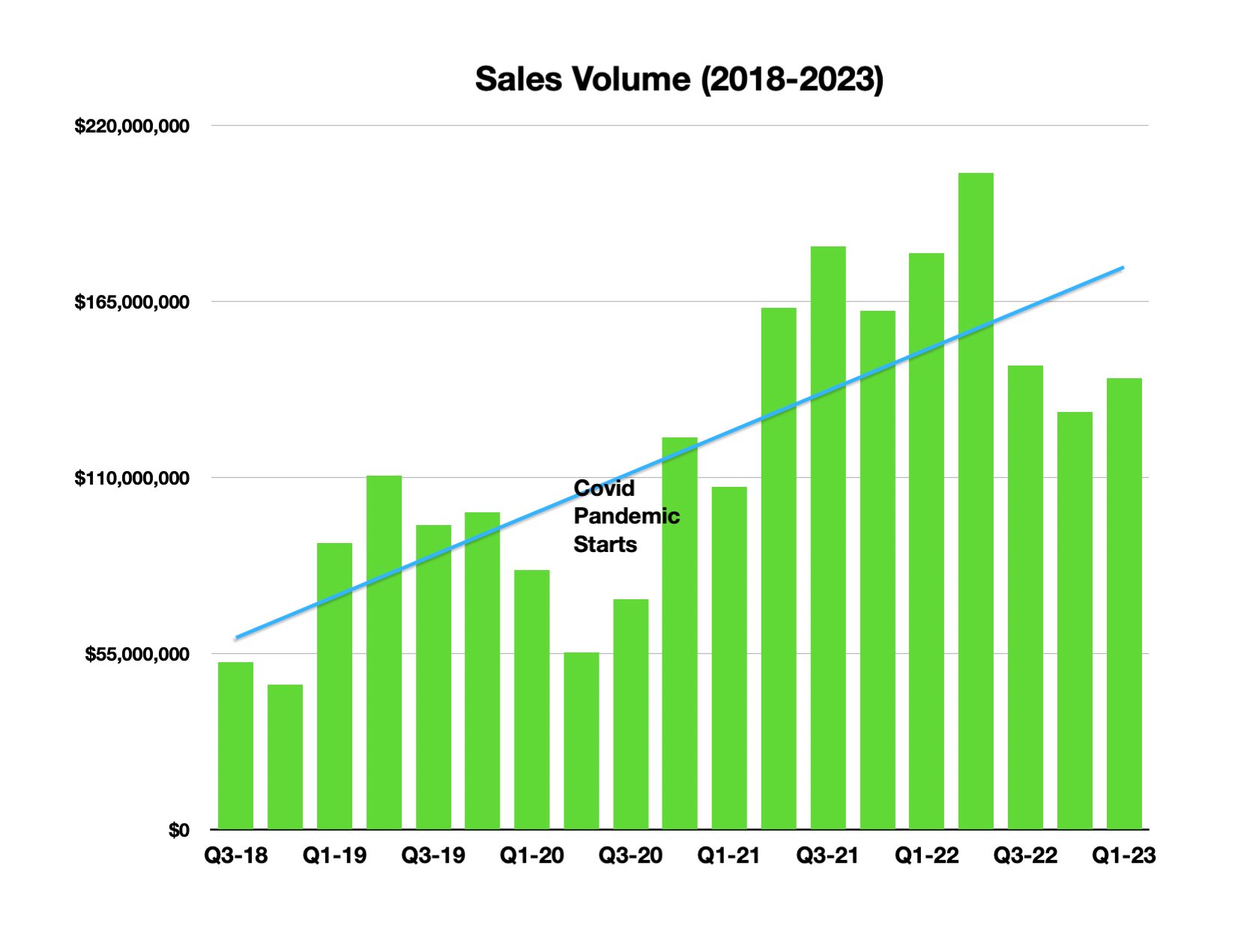

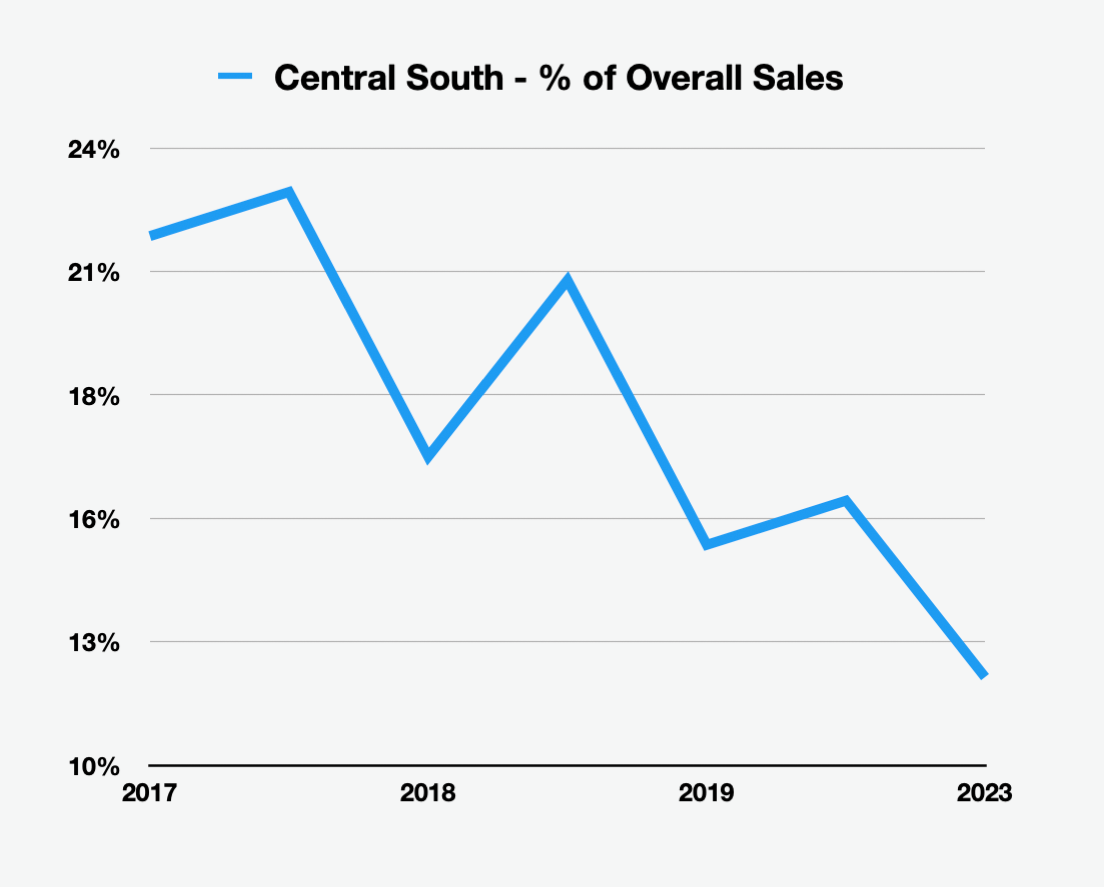

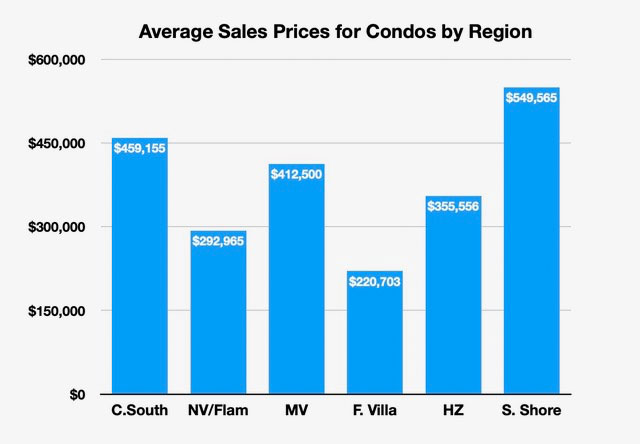

The region with the most activity with 19% of all sales was Nuevo Vallarta/Flamingos, followed by Bucerias, which accounted for a surprising 17% of sales (usually it is around 10%). The loser was the downtown region, Centro South, which dropped from a high of 23% of all sales in 2017, to just 11% in the first quarter of this year. Why’s that? There’s a few reasons. First, starting about 10 years ago, the first market area to recover from the 2008 real estate crash was the downtown, more specifically Central South. Developers could build condominiums off the beach but in the center of town for a reasonable price and offer very popular amenities such as rooftop pools and lounge areas that for many offered panoramic views. They helped lead the recovery in the marketplace. Secondly, in a downturn or recovering market, at least for the Vallarta/Nayarit region, people tend to want something close to the downtown core. As the market improves prices go up because of demand (The average sales price in Central South downtown last year was $452,000 whereas it was only $252,000 in Francisco Villa). Prospective buyers tend to then gravitate to outside areas where property prices aren’t as expensive. That’s what’s happening now, with increased demand outside of Vallarta into Nayarit, and especially behind Vallarta in the region referred to as Francisco Villa, which includes the neighborhoods of Versalles, Fluvial, and Las Gaviotas. This is reflected in the two graphs below:

Overall sales volume has dropped not so much because of demand, but because of supply. There isn’t enough good quality properties on the market for the number of people looking. So there’s good reason to think that prices will continue to go up until that demand can be met.

We are a law firm Located in Puerto Vallarta, made up of bilingual lawyers who work under the strictest international standards of ethics and professionalism.

Our main objective is to help our clients protect their investments throughout a Real Estate transaction with peace of mind.

Bahía de Banderas

If you want to stay in Mexico for more than six months then you’re going to have to apply for a resident visa, which generally allows you to stay a year or more in the country legally. You apply for a residency visa not in Mexico but at a Mexican consulate in your home country.

Financial solvency requirements for your resident visa will be based on a calculation using Mexico’s minimum wage, which recently went up again, by 20%, to $207.44 pesos (about US $10.80) per day. So be sure that any calculations you make reflect the new minimum daily wage. Each consulate has different ways of converting the minimum wage into euros, U.S. dollars, Canadian dollars or whatever the currency is where you are from, so how much your requirement will depend on the calculations of whichever consulate you use to apply. While currency conversions may vary from consulate to consulate, the value of income, savings and investments you must demonstrate to qualify for a residency visa is based on a single factor: Mexico’s daily minimum wage.

A temporary residency visa can cover a period of more than 180 days to up to four years — how many years is at the discretion of Mexico’s National Migration Institute (INM) after you get your visa. Generally speaking, you are eligible to renew your temporary visa for four consecutive years with little fuss. The problem here is that you are at the mercy of what the immigration office and/or officer you deal with. Some are more lenient than others and you never really know until you talk with one.

A permanent residency visa is for those looking to stay in Mexico indefinitely. It’s generally granted to foreigners who plan to be retirees in Mexico (you must be 65 or older for this) or else people who are dependents of a Mexican permanent resident or citizen, or who are the parent or child of a Mexican citizen.

In both cases, applicants must demonstrate financial solvency to guarantee to Mexico that they have the means of providing for themselves and any family members that are coming with them.

If you’re applying for a temporary residency visa, to prove financial solvency, you must demonstrate one of the following:

SALARIED INCOME: your income during the past three months must equal or be greater than 100 days of the general minimum wage (as applied in Mexico City), and you must also show proof of current, stable employment outside Mexico for at least one year.

PASSIVE INCOME: the total amount of your investment, savings and pension income over the last 12 months must have an average monthly balance equal to 300 days of the general minimum wage applicable in Mexico City.

A family moving to Mexico can apply for temporary residency, but be aware that there will be a financial solvency requirement for each adult and each minor child. Ask your consulate for specifics.

Many foreigners are under the impression that owning real estate in Mexico means that getting a Mexican visa is guaranteed, and only for a temporary visa. There’s no guarantee, however, that owning a home or other real estate in Mexico will alone qualify you for residency. Consulates appear to have discretion when it comes to using this as a qualifying factor. But if they do allow it, you’ll need to provide an original and a photocopy of the property’s Escritura Pública (the official deed to the property granted before a Notary Public in Mexico). The value of the property stated on the escritura (title) must exceed 40,000 days of the general minimum wage for it to be considered. Note: real estate ownership will only ever qualify you for a temporary residency visa.

Yes, but it only qualifies you for temporary residency. If you’re an investor in a Mexican company or conduct business in the country, the amount of the investment or value of business conducted must equal 20,000 days of the general minimum wage.

How to show proof: provide original and photocopied documents of one of the following:

If you’re applying for a permanent residency visa, you need to show:

Applying for a visa doesn’t happen in Mexico but in your home country, at the Mexican consulate. Be aware that in all cases, consulates expect that you will provide your own photocopies of the documents you are submitting. Don’t expect them to make copies for you when you get there. Your consulate may even ask to keep originals. If you don’t want to give up your original documents, ask ahead if a certified copy granted before a Notary Public can be accepted as an original. A certified copy is considered to be equal to an original unless in specific cases mandated by the authorities. So make sure to ask.

According to Mexican officials, it will take up to 10 working days in any of the aforementioned cases.

If the visa is granted, your next step is to obtain your residency card in Mexico. The deadline to apply for the residency card is 30 calendar days after entering Mexican territory. This can be done at any INM office in Mexico. This process can’t be done at Mexican consulates or embassies, itt must be done at an INM office. The consulate only gives you general approval for a visa. INM will be the final arbiter of for how long your first temporary visa will be valid — up to a maximum of four years.

Many foreigners from countries that aren’t required to obtain a tourist visa to enter Mexico (e.g. U.S., Canada, Schengen Area countries; see this link for the full list of countries) are granted at least a year and are eligible to renew upon their first visa’s expiration.

You must notify the immigration authority of any change in your marital status, nationality, the address where you live or your place of work within 90 days after said change occurs.

Thanks to the Mexico News Daily for their article on this matter.

If you have been active in the real estate market in recent months, it is likely that you have read or heard about a new regulation that involves PROFECO (Mexico’s Consumer Protection Agency) and providers of real estate services. This has given rise to all kinds of questions and concerns, which we will seek to clarify below.

First of all, we are going to give a bit of context around this Official Mexican Norm. This norm, called “Commercial practices-requirements for commercial information and advertising of real estate intended for housing and minimum elements that related contracts must contain”, is mandatory at the national level for all providers of the real estate industry and entered into force on September 19 of this year.

Although the norm was created with the intent of mainly regulating the purchase and sale of new housing by developers and builders, it was extended to also include real estate intermediaries.

Even though the Puerto Vallarta and Riviera Nayarit chapters of AMPI (Mexican Real Estate Association) have managed to establish a high industry standard for those who are members this association, real estate marketing practices have had very little official regulation in other parts of Mexico, and in many cases, they are involved in problems that affect consumers and therefore their assets.

The objective of this standard is to guarantee consumer protection when buying a home. In other words, NOM 247 indicates the “good act” for those who are dedicated to marketing and selling real estate and establish what they must offer and guarantee.

Therefore, the norm was conceived with the perspective of always seeking the good of the consumer, eliminating bad practices: abusive, unfair or discriminatory, and reducing fraud against the interests of the client.

This norm establishes that suppliers are obliged to inform and respect prices, rates, guarantees, qualities, measurements, materials, finishes, insurance, interest, charges, terms, form and conditions of payment, deadlines, dates and other conditions applicable in commercialization, especially those that have been offered for the delivery of a real estate property, and also dictates the guidelines and minimum information requirements for the commercialization of real estate intended for residential use, such as:

In terms of advertising and promotion, the norm document states that marketing must prioritize responsibility and transparency at all times through truthful, verifiable, clear information that is free of elements that mislead or confuse the consumer due to being misleading or abusive.

One of the most debated questions and points in recent months is the fact of whether or not the rule must be observed by individuals who wish to carry out a real estate purchase and sale operation. It should be noted that this rule is not mandatory for those individuals who intend to transfer their home, but only for those who are service providers.

The NOM defines service providers as developers, builders, promoters, intermediaries in consulting or sales, and in general any natural or legal person who is directly or indirectly dedicated to marketing real estate to the general public for housing.

Consequently, real estate transactions between individuals may continue to be carried out without any change. However, if an intermediary participates, the guidelines indicated in the norm must be observed.

And this is where another series of questions comes in, why does a real estate agency / realtor ask me to sign such an extensive listing agreement? Is it mandatory to use this contract? Why do they ask me for so many documents? What benefits do I have by signing this contract?

The answer is simple; your realtor is looking to provide you with a high degree of professional service that complies with regulations in Mexico and that guarantees your rights as a client, and also to ensure the interests of the future buyer. This translates into more work and responsibility for the service provider on your behalf and the question, if that were the case, should be rather why is he/she not complying with what is established in the norm?

The listing agreement contract is mainly based on an adhesion contract model of which there are two versions, a PROFECO version and an AMPI version. Both are valid and have a similar content seeking to standardize the provision of the service, guaranteeing minimum rights and obligations for the parties.

Any version that your provider provides must have its own registration folio before the Public Registry of Adhesion Contracts of PROFECO, and must contain, among other things:

One of the most notable benefits for the client is that PROFECO’s competence would allow faster reconciliation if necessary.

In my opinion, this NOM-247 will have a positive impact on reducing the number of operations that may affect the patrimony of consumers in terms of housing in Mexico, but above all, it is a norm that will require the continued professionalization of the activity of participants in the real estate industry and further standardizing the terms of service and sale.

This article was written and provided by David Moreno of LARIVIERA Group

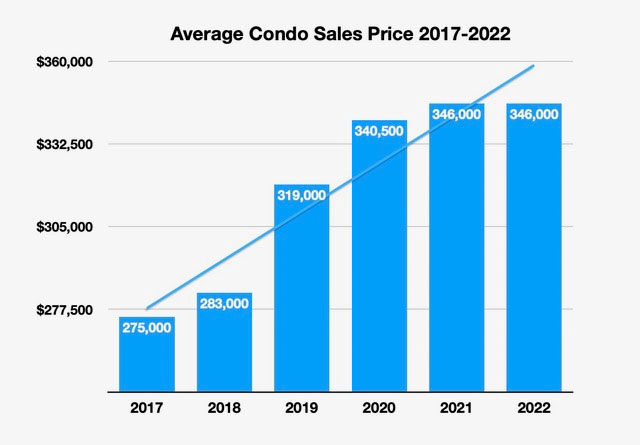

2022 turned out to be another exceptional year for the local real estate industry performing slighting ahead of 2021 in terms of both dollar volume and number of sales. And there’s no better way to review how they year went than with charts, which always speak louder than words, and certainly can be more fun to explore.

After losing ground in 2020 to covid, sales rebounded robustly in 2021 and managed to keep it up into 2022.

On closer inspection, however, by reviewing sales volume by quarter we see the market has dropped considerably since mid’ year, as shown in the chart below.

And it doesn’t seem to be for lack of demand, but rather it’s a supply problem – there just aren’t as many people interested in selling as there are people wanting to buy, and new product development is having a hard time keeping up. Whenever inventory becomes scarce, it usually leads to a considerable difference between the listing or asking price, and the eventual agreed-upon sales price. Back in 2017, the spread was nearly ten percent. In 2022 it was less than five percent.

And although the average condominium sales price remained the same as in 2021, when we look at just two-bedroom units, we see they are continuing to get increasingly more expensive. Which, again, we’d expect when demand is greater than supply.

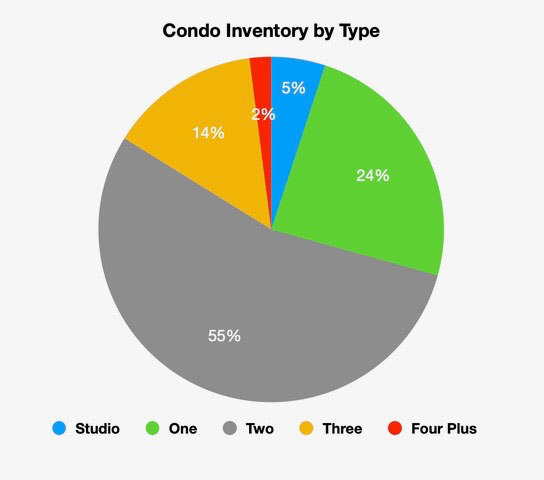

The two-bedroom condominium is by far the most popular type of condo preferred by buyers, holding 55% market share and has done so long as we’ve been providing statistics on the region. And the split has remained this way quite consistently over the years for all bedroom-unit types.

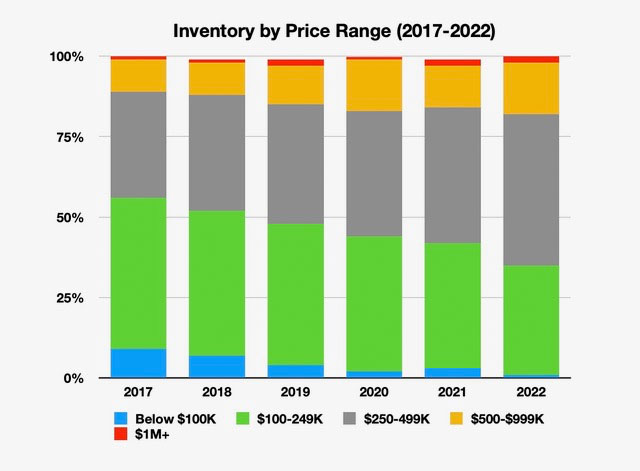

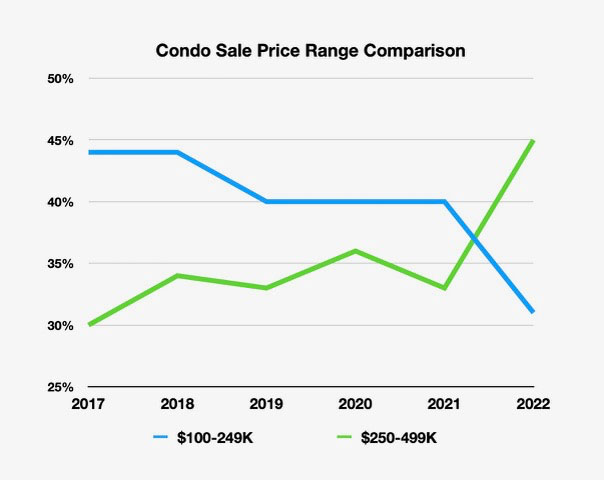

When considering the inventories of condominiums by price range, as shown below, the perceived trend is that real estate prices are getting more expensive. In 2022 there will only five condo reported sold for under $100,000 (in blue below).

The most drastic changes we seen in price ranges lies between $100-$249,000 and $250-$500,000. The former used to make up nearly 45% of the market whereas the latter made up only 30%. In 2022 they reversed one another with condos between $250-$500,000 now making up 45% of the overall condo market.

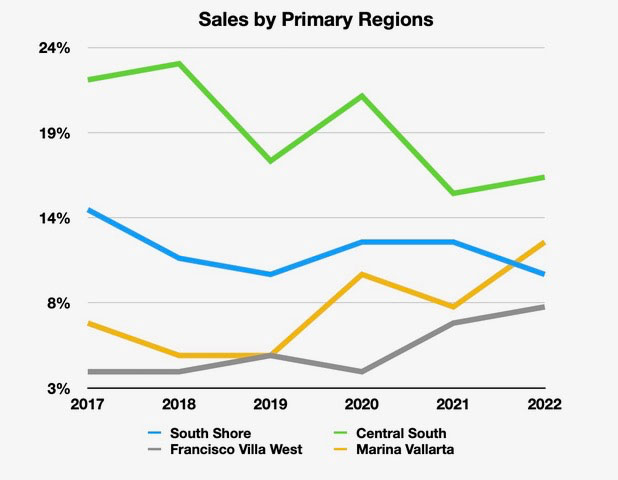

There’s been some interesting shifts in market regions as well. The downtown region, south of the Rio Cuale known ans Central South, has been dominating sales for years, but it has been dropping, from taking 23% of all condo sales in 2018 to just 16% in 2022. Where’s the growth to make up for this? Coming from a resurgent Marina Vallarta and Francisco Villa, the region between the Hotel Zone and Avenida Francisco Villa, also commonly known as Versalles, Gaviotas, Fluvial or Diaz Ordáz.

This increased demand for Francisco Villa is probably because of the average price per condo in this area, which is substantially below that of over popular regions, as shown below.

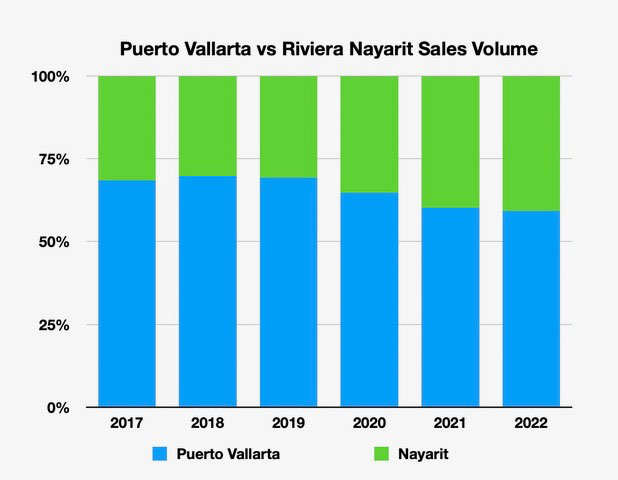

Another trend, although a slower one, is the transition from a dominant Puerto Vallarta market to a much stronger Riviera Nayarit market. This has been going on for years and probably won’t be changing anytime soon as that’s where the land is – there just isn’t as much, especially beachfront, in Puerto Vallarta. And the South Shore is limited by the coastal mountains and the fact that most of it isn’t accessible by road. Riviera Nayarit is also much closer by road to primary national markets such as Guadalajara and the Bajio region.

Overall a very interesting year, setting up for what will most likely continue to be quite interesting moving into 2023 where there are rumors of recessions to the north, higher interest rates and slowing American and Canadian real estate markets – how will these conditions, if they continue to play out, affect the local market?

The following graphs are generated from information provided by members of MLSVallarta and FLEXMLS, two MLS systems operating and servicing the Puerto Vallarta – Riviera Nayarit regions. Missing from these numbers is Punta de Mita which is an upscale, market-unto-itself. Real Estate here is sold by a few agencies that tend to specialize in just this area, and report few of their sales. It is estimated, however, to generate sales volume somewhere around $200 million, or about 25-30% the size of the overall Vallarta/Nayarit market.